With November figures in, it is clear once again that the year 2017 breaks one air cargo record after another. The record volume worldwide, as seen in October, has already been relegated to the history books one month later: November beat October by 1.3%. For the third month in a row, the year-over-year (YoY) yield increase in USD had to be written in double figures, this time the highest since the recovery after the 2009-crisis: +17.3% YoY (note that the price of jet fuel increased by 35% over the same period).

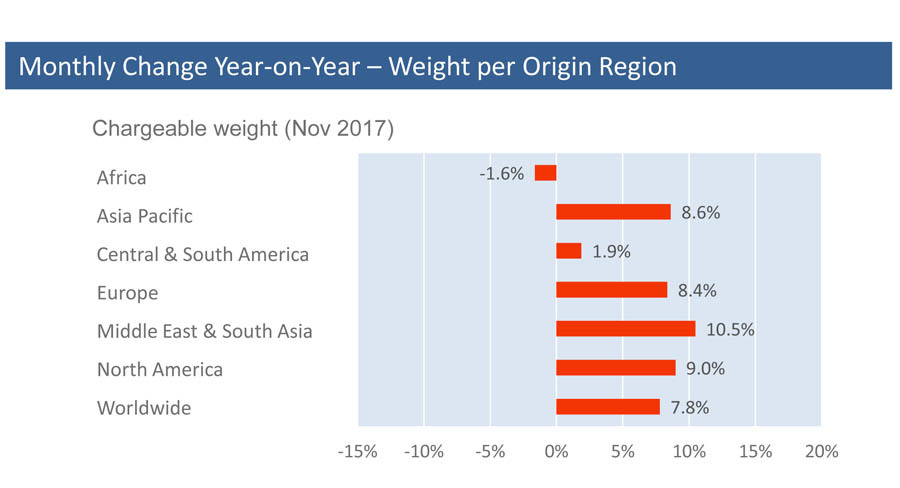

With volumes growing YoY at 7.8% in November (and 8.9% in DTK), airline revenues in USD for the month were more than 26% higher than in November 2016. The WorldACD volume index, showing every month the moving average for the then last 12 months, steadily increased over the course of 2017, from just over 120 in January to 131.6 in November (year 2008 = 100).

The most striking feature of the November figures was the yield increase from Europe. Measured in EUR, yields jumped by almost 19% YoY to all destinations worldwide. The Americas played an important part in this jump: YoY yields from Europe to destination North America rose by 28% and to Central & South America (C&SA) by 25% (in USD the figures were 40% and 36% respectively). Other origin areas shared in the USD-yield bonanza, with the exception of C&SA, which saw its overall yield decrease slightly YoY; yields to its most important destination - North America - showed a marginal improvement of 1.3% YoY.

In terms of November-volumes, a number of markets showed double digit growth figures YoY. In the larger markets, these were Asia Pacific to North America (+11.5%), Europe to Middle East & South Asia (MESA) (+11.3%), and MESA to Europe (+21.1%). Of the smaller markets, we mention C&SA to Europe (+12.2%), North America to MESA (+19.5%), and MESA to Africa (+20.1%). Asia Pacific strengthened its position as prime growth market.

Looking at the various groups of airlines, we noted that airlines from Africa, North America Asia Pacific and Europe contributed more than average to the YoY volume growth of 7.8%. They managed to grow by 14.5%, 11.4%, 9.4% and 8.7% respectively. Airlines based in MESA grew by 5.2% YoY, whilst airlines from Central & South America saw their total volume decrease by 6.4%. Of the airlines growing more than 20% YoY, three are based in Africa, three in Europe and two in MESA

Sebagai bentuk apresiasi atas dedikasi dan loyalitas para karyawan, JNE kembali memberangkatkan 44 Ksatria dan Srikandi beragama Nasrani untuk melaksanakan perjalanan rohani ke Holyland.

…DetailsMenteri Perhubungan Dudy Purwagandhi mengatakan bahwa Dewan Perwakilan Rakyat Republik Indonesia (DPR RI) khususnya Komisi V

…DetailsMenteri Perhubungan Dudy Purwagandhi menyampaikan hasil penyelenggaraan angkutan Lebaran 2025 pada Rapat Kerja dengan Komisi V DPR RI terkait Evaluasi

…DetailsJNE bersama Institut Pariwisata Trisakti (IPT) resmi melakukan penandatanganan kesepakatan kerjasama pada hari Selasa, 22 April 2025 di Auditorium IP Trisakti.

…Details