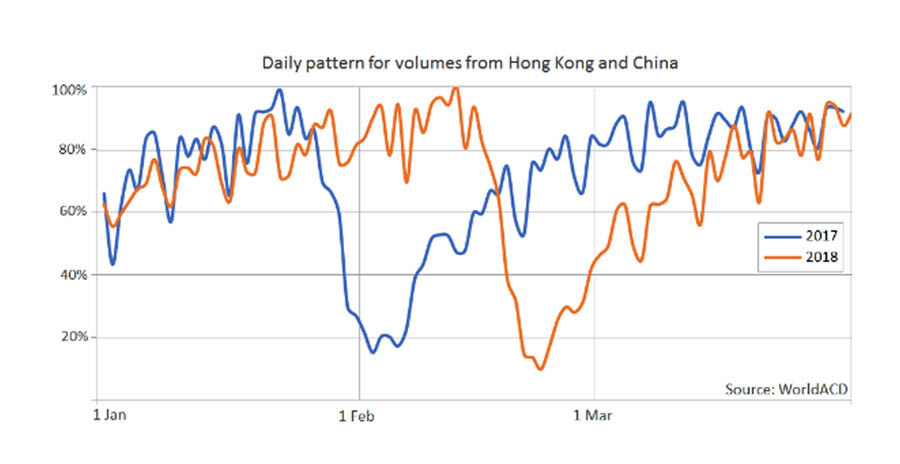

With March-figures in, at last we can write the real story of the year-over-year (YoY) air cargo performance in early 2018. We had to wait until the full effects of Chinese New Year were known, since Chinese New Year - effects resonate in the air cargo community worldwide: as mentioned last month, this year the effects were visible well into March (see the chart below, showing daily volumes from China and Hong Kong in 2017 and 2018).

In March 2018, we saw worldwide air cargo volumes increase by a mere 0.9% YoY. Combined with the very strong market in January and the more modest growth in February, this brings up a volume growth in Q1 of 4.8% YoY. In air cargo exports, the Southern hemisphere did best and worst: Central & South America grew by 12%, whilst Africa lost 3.3%. In incoming volumes, the European market grew by 7%, whilst the Middle East & South Asia had to content itself with a very modest growth of 0.6%.

Of the top-30 origins in the world, the best performers in Q1 - chalking up double-digit growth figures - were Turkey (+20.6%), Japan (+17.8% YoY) and Ecuador (+12.2%). Among the world's largest "country pairs", the markets from Japan to China East (+24% YoY), from Germany to India (+19.2%) and from Chile to USA South Atlantic (+17.6%) stood out for the right reasons; Hong Kong to Germany (-9.9%) and Japan to Taiwan (-6.8%) topped a list of large country pairs losing some of their lustre.

But let's turn to the increase in yield including charges (price/kg), which makes for an important part of the real story of this year's first months... We read all the time how yields are "soaring". So far, the actual picture is more nuanced than that. We need only point to the fact that the YoY yield increase in Q1 (worldwide) was 18.6% when measured in USD, but only 2.7% when expressing it in EUR...A similar pattern is seen when comparing yields in USD with yields in almost any other major currency.

In other words, the large yield increase in USD can only be understood against the background of the loss the USD suffered against many other currencies when comparing Q1-2018 with Q1-2017. The "greenback" lost 13% against the Euro, 11% against the British Pound, 8% against the Chinese Yuan and 5% against the Japanese Yen, to name some of the currencies of importance to many large air cargo companies.

Take the case of European vs American carriers on the North Atlantic, one of the largest intercontinental markets in the world. With a weak dollar and a strong Euro, one would expect incoming business in Europe and outgoing business from North America to grow fastest. That is precisely the case, even though for both airline groupings the larger part of their total North Atlantic business (56% to be precise) still goes in the westerly direction. From Europe to North America, the YoY increase was 33.8% in USD, but a much smaller 15.9% in EUR. In the other direction, yields increased by 8% in USD, but decreased by 6.5% in EUR. The CFO of a US airline, thinking and accounting in USD, will be clearly pleased, but his European counterpart, thinking and accounting in EUR, much less so. Add to this that jet fuel prices have almost doubled over the past two years, and we understand that the recent large yield increase as measured in USD, may take on a different meaning for different parties.

Pembagian daging kurban dilakukan langsung oleh Yulina Hastuti, Dirut TIKI, dan M. Feriadi Soeprapto, Presdir JNE kepada perwakilan ibu janda dan anak yatim dari YATUNA

…DetailsSelain sebagai Plt. dan Direktur Corporate Safety & Quality, Capt. Achmad juga ditunjuk sebagai Dirut PT AirAsia Indonesia Tbk., perusahaan induk dari IAA.

…DetailsSebagai Bandara Internasional yaitu dalam rangka peningkatan pertumbuhan ekonomi daerah, pengembangan pariwisata, serta peningkatan investasi dan perdagangan.

…DetailsPemanfaatan drone, pesawat patroli, serta sistem navigasi dan komunikasi penerbangan akan mempercepat respon pengawasan, memperluas jangkauan di wilayah laut Indonesia.

…Details